Stytch for payment fraud & loss prevention

Advanced payment fraud & loss prevention: delivered by Stytch

Stytch Fraud and Risk Prevention detects and blocks threats from users, bots and AI agents—before an order is even placed.

Catch both the attacks of today, and the future

Stop payment fraud: Instantly detect unauthorized transactions and promotion abuse.

Improve user experiences: Identify trusted users before sign-in to minimize verification steps like OTP and 2FA.

Prevent automated abuse: Block bots exploiting promotions, discounts, listing manipulation and card testing.

Avoid malicious chargebacks: Gather detailed device and user evidence to identify fraudulent claims.

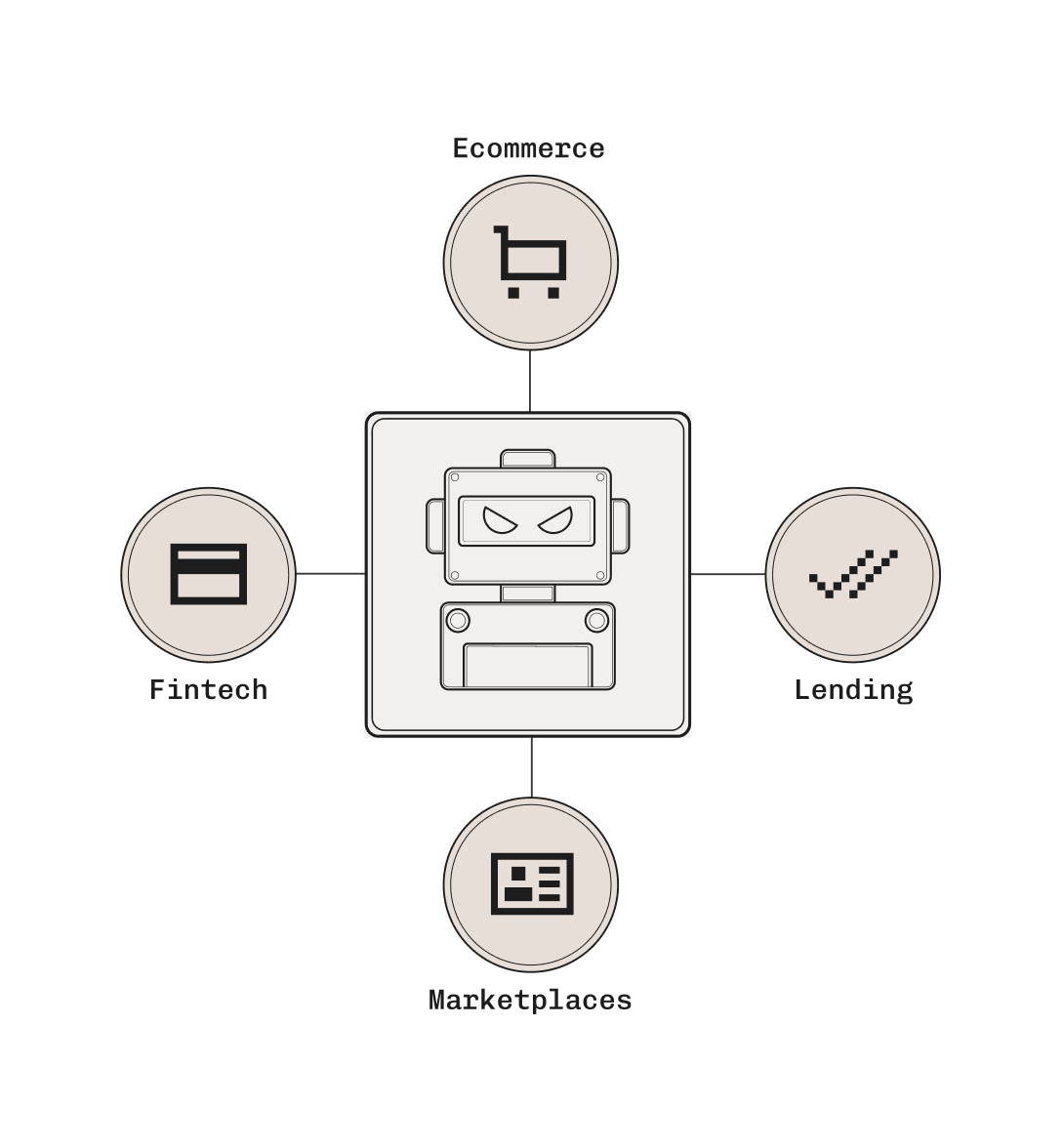

For whatever product that needs protecting

Ecommerce

Automatically detect and block fraudulent orders

Chargebacks: Identify suspicious transactions at checkout, avoiding chargeback abuse.

Promo abuse: Detect accounts abusing free offers and trials, limiting them to their one promotional offer.

Bot-related attacks: Proactively block affiliate abuse, automated scalpers, card-testing bots, credential stuffing, and more.

Marketplaces

Prevent fraudulent listings and multi-account abuse

Multi-account abuse: Detect and shut down accounts with the same owner quickly.

Fake listings: Identify and remove deceptive listings immediately, keeping your brand reputation intact.

Bot manipulation: Stop bots from skewing listings, reviews, pricing, and other marketplace interactions.

Fintech and payments

Real-time transaction and account security

Unauthorized transactions: Immediately detect and halt fraudulent payment attempts and frequent abusers.

Account takeover: Identify and prevent unauthorized access from malicious threats for improved security.

AI-driven attacks: Block advanced AI-powered fraud schemes effectively with advanced AI agent detection.

Lending and verification

Secure lending decisions and identity confirmation

Fraudulent applications: Automatically flag and block suspicious loan applicants.

Identity spoofing: Strengthen identity checks through secure, integrated data.

Risk assessment: Leverage comprehensive insights to make safer lending decisions, even from regions with less financial reporting.

Solved by Stytch

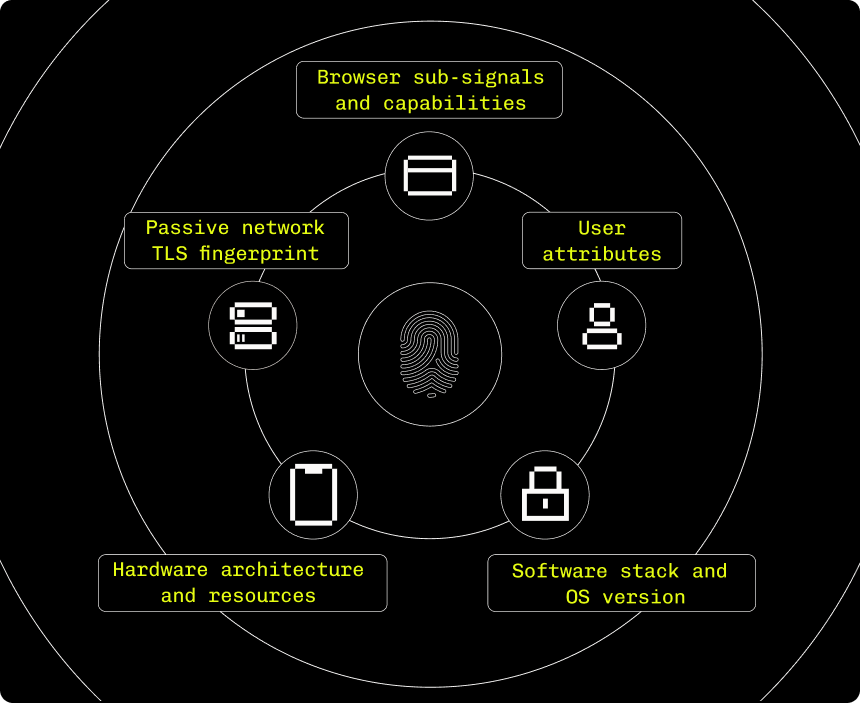

Industry-leading device intelligence

99.99% accurate device and bot detection: Best in category device intelligence with minimal false positives.

ML-Powered device detection: Machine learning programmatically detects new threats, device types, and spoofed attributes in real time.

Zero-day fraud detection: Quickly recognize and respond to emerging fraud schemes before they escalate.

AI agent detection & monitoring: Detect AI agents like OpenAI’s Operator, giving you the power to monitor allow, or restrict AI-driven activity.

Frictionless sign-in and checkout

Better than CAPTCHA: Block malicious bots invisibly, maintaining seamless user experiences.

Dynamic authentication: Less manual verification for trusted users, increasing retention for your sign in flow.

Intelligent Rate Limiting: Only rate limit suspicious traffic, keeping genuine user interactions unaffected.

Ultra-low latency: Minimal impact to page responsiveness, averaging 6x lower latency than the competition.

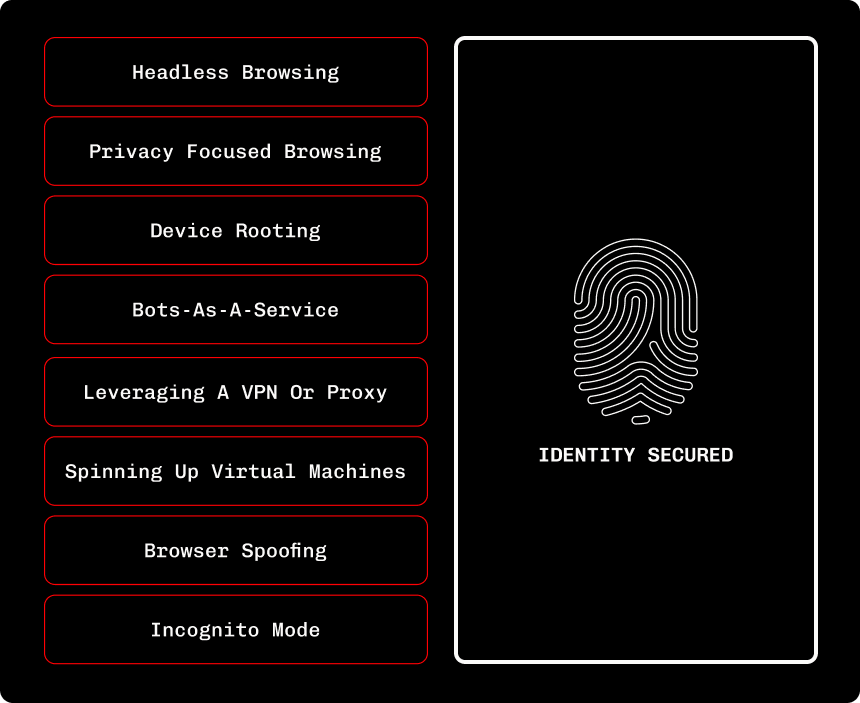

Highly-resilient security

Spoof and tamper resistant: Secure against reverse engineering, spoofing, emulators, and anti-detection techniques.

Detailed fraud insights: Extensive data and signals provided to effectively investigate and combat fraud in real-time.

Client-side encryption: Encryption at rest and in transit to prevent reverse engineering.

Customizable risk thresholds: Easily adjust fraud detection sensitivity and actions to match your specific business needs.

After seeing a huge spike in traffic from bot farms, we turned to Stytch Device Fingerprinting and made significant breakthroughs in reducing bot and fraud activity, all within a matter of weeks.

After seeing a huge spike in traffic from bot farms, we turned to Stytch Device Fingerprinting and made significant breakthroughs in reducing bot and fraud activity, all within a matter of weeks.