Back to blog

A founder’s guide to raising your seed round

Company

Aug 11, 2022

Author: Reed McGinley-Stempel

I’m often asked by other founders about Stytch’s seed fundraising experience and what advice I’d give to other early-stage founders navigating the process today. While the overall fundraising environment has shifted in recent months, I think my advice for approaching a seed fundraise still fundamentally applies in the current market. I wanted to take a moment to put in writing what I’ve shared with many founders one-on-one, with the hope of ultimately being helpful to a wider audience.

There are many things you can’t control when entering the fundraising process: an investor’s predisposition (or lack thereof) to your idea and space, your team’s background, the market environment, or even a VC’s relative mood on pitch day.

But there are two concrete things you do have control over:

- How you craft your pitch deck

- How you structure the fundraise process and timeline

These likely sound obvious, but there are some tactical learnings we had during our seed fundraise (both through the helpful advice of others and through our own initial mistakes) that I share with every early-stage founder who asks for advice on raising capital.

1. Craft a pitch that hits the right notes

You likely have a pretty good idea of what a pitch deck should look like, and there are lots of other great materials out there on what to include in your deck (founding backstory, market sizing, etc.). To avoid being repetitive, I’ll focus on two very specific learnings that helped elevate the conversations we were having with VCs and ultimately led to a competitive fundraise for Stytch’s seed round.

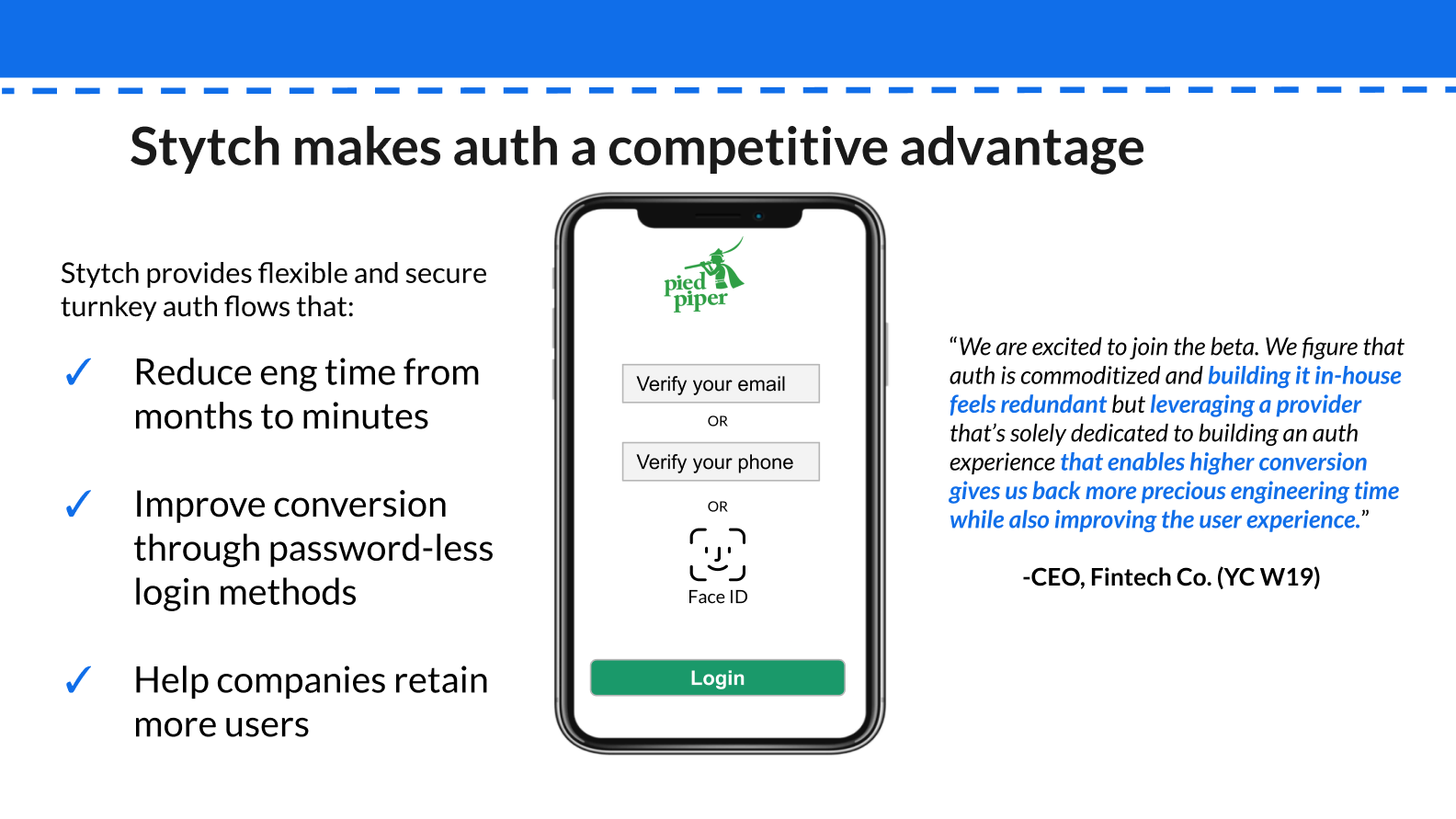

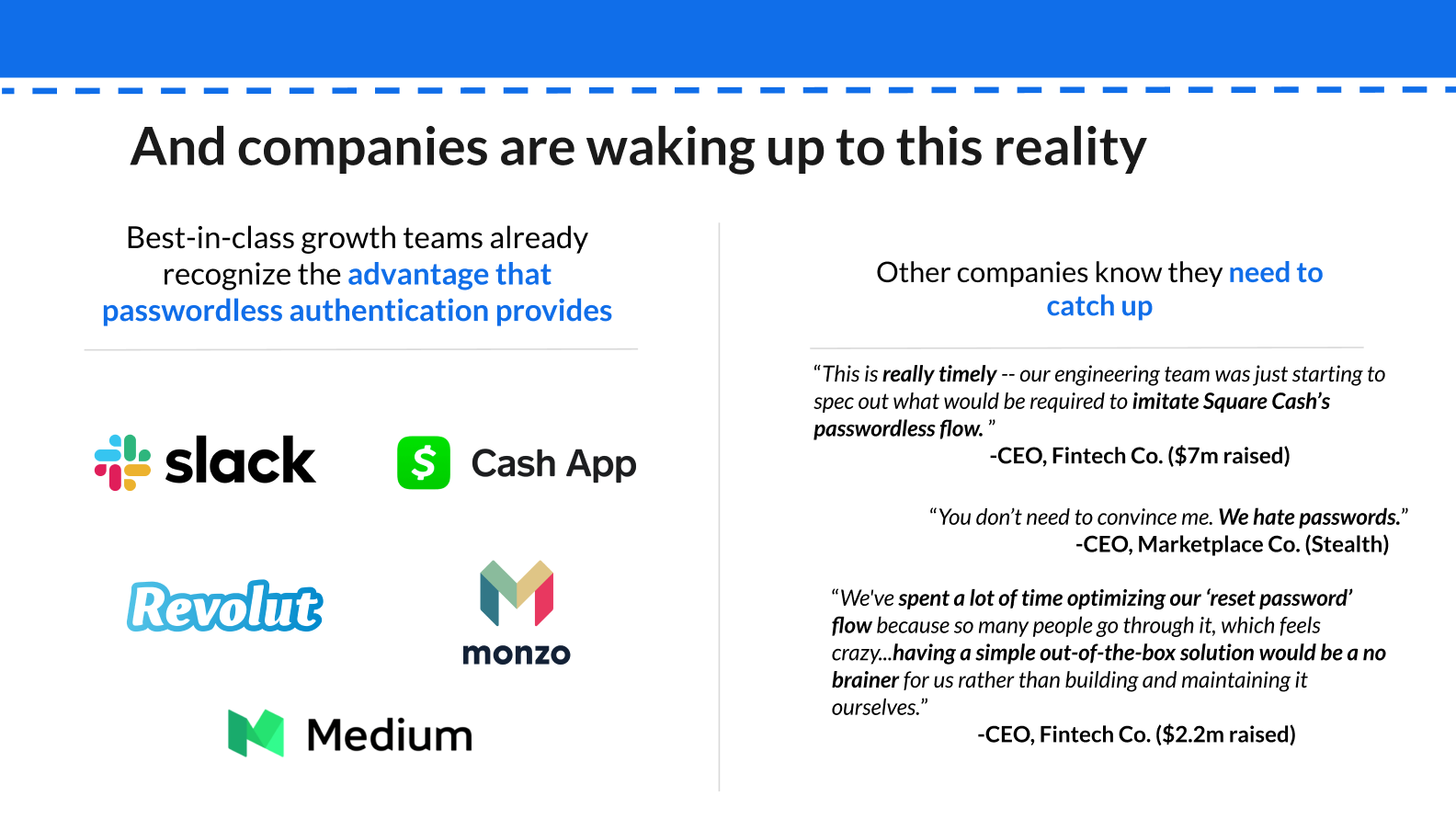

Anecdotal Data is underrated – use it to show expertise and make the problem more tangible to VCs

Quantitative data is great, but at the earliest stages, you often don’t have that much of it. During your pre-seed or seed fundraise, qualitative data will play an outsized role in convincing VCs (a) whether the problem you’re tackling is worth solving, (b) how acute the pain is for potential customers, and (c) whether there is founder-market fit with your startup (i.e. are you the right person to build this idea?).

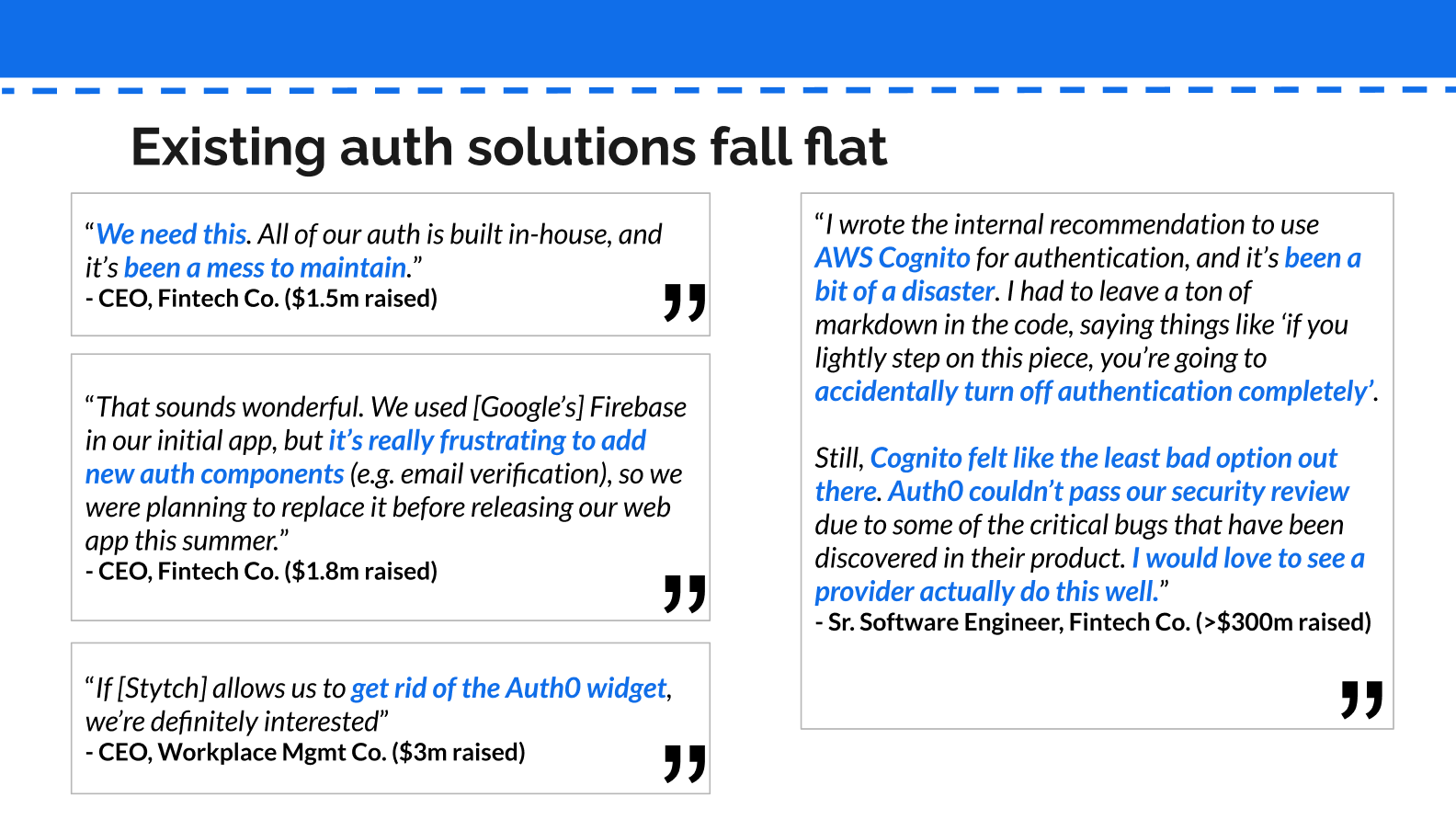

Early stage VCs tend to be storytellers, so rather than dismissing anecdotal data, they actually embrace it – if you’re able to provide insightful anecdata (whether it’s user quotes, interviews, etc.), they can often be what VCs remember most vividly from the pitch. My recommendation is to find ways to weave in qualitative data throughout the presentation. This will be more effective than just dedicating one slide at the end to customer quotes. As an example, we included ten detailed quotes from interested customers on three different slides to help highlight the point we were making on each one.

The other advantage of weaving the right anecdata into your pitch is that it allows you to show your expertise on the topic and the extensive research that you’ve put into the space. That, in itself, is a superpower – you should know 10 to 100 times more about your subject than everyone else in the room. Demonstrating that level of expertise is powerful, and while it can be hard to show this in a 30-minute conversation with a VC, things like prospect or customer quotes help reveal how deeply you’ve investigated the space. Lean heavily into the deep conversations you’ve had with users and customers to craft a compelling pitch that demonstrates your familiarity with the pain you’re looking to address.

Here are a couple examples of how we weaved prospect quotes into our seed deck:

Make sure you have 1-2 slides at the end of the deck that help answer the following question: how could this ultimately be a $50B or $100B company?

As mentioned above, showing your expertise in the immediate problem to be solved is important. That said, it’s often easy to get too deep into the weeds, and it’s important to also take a step back and recognize your VC audience and their ultimate goal - returning the fund.

One of the most helpful pieces of advice we received when preparing our deck was to explicitly outline how Stytch could become a $100B company. You’ll want to illustrate how your company can reach that scale in the next decade to truly excite VCs about your potential given the power law curve governing venture capital’s investment strategy.

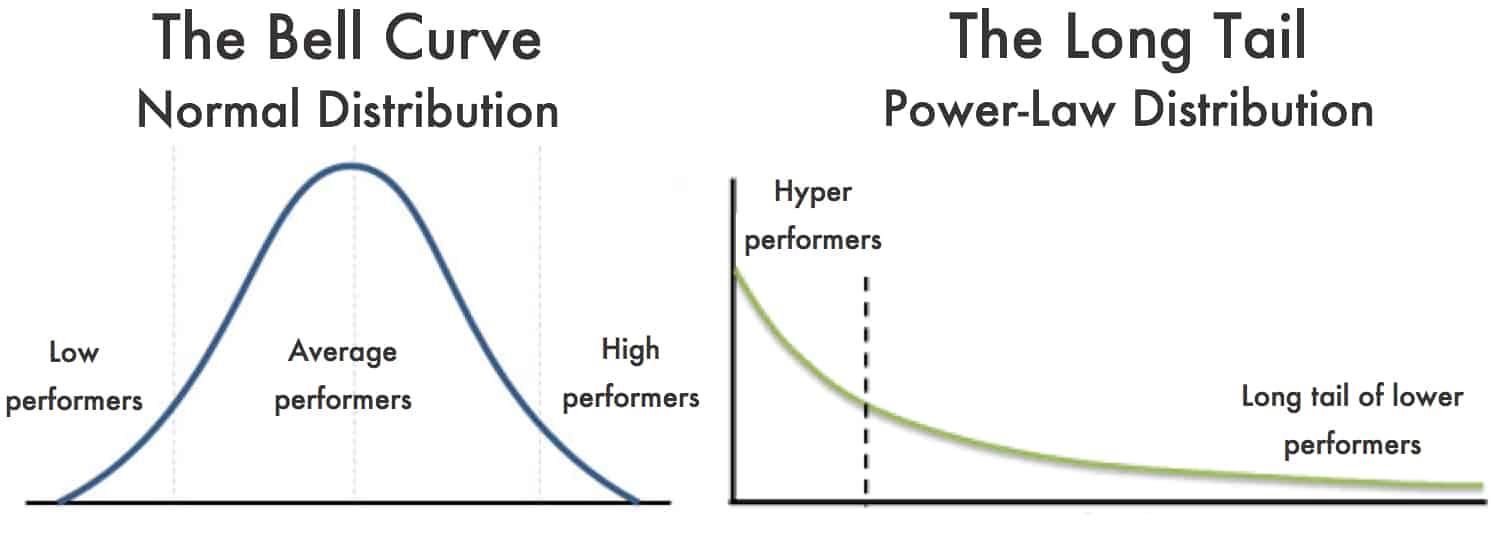

It’s helpful to understand the psychology of how VCs approach investment bets. Venture capital performance follows a power law curve rather than a normal distribution:

Effectively, this means that a few great outlier performances will be responsible for determining whether a venture fund is successful. VCs need extremely high payouts on the few bets that perform well in order to justify the illiquidity of the asset class (without the potential of such outsized returns, LPs would be better served allocating their funds into a more liquid asset).

And while VCs know they need to find a few massive winners, they also understand that most investments in the fund will be underperformers. VCs are much more worried about missing an incredible positive outlier than they are about investing in a company that returns little to none of their investment. When you consider the psychology of how VCs invest, it becomes clear why you’ll want to argue how your company could be one of the few hyper performers in their portfolio if things go well. Very rarely is it obvious how a startup could become a $50B or $100B company – it’s much safer to explicitly outline how your startup could achieve this rather than expecting a VC to craft this narrative for you.

When we raised Stytch’s seed round, the most comparable company in our market (Auth0) had recently been valued at $1.9B. That’s obviously an impressive sum, but it’s not an extraordinary valuation since even surpassing Auth0 wouldn’t necessarily return the fund for many of the VCs we were pitching to.

While my co-founder and I had a firm idea for what could potentially enable us to build Stytch into an eye-popping valuation if the early years went well, I initially struggled to convey this in our pitch deck. Admittedly, it can feel absurd – even arrogant – to be thinking on such a large scale when you’re still pre-revenue, but VCs want to know that you’re thinking about the 10-year+ vision.

Chances are you won’t build a $100B+ company (exceptionally few people will), but given the type of founder mindset VCs want to bet on, you need to clearly articulate how this initial idea could grow into something much larger.

Note: If you’d like a copy of our seed pitch deck, feel free to reach out to us at startups@stytch.com and we’ll be happy to share it and answer any questions you have about the fundraising process.

2. Run a tight fundraising process

Just as important as the pitch deck is how you actually run the fundraise process itself. Being intentional and streamlined in your approach can help elicit more bids under better terms. Being unintentional often leads to fundraising rounds that drag on and suboptimal terms.

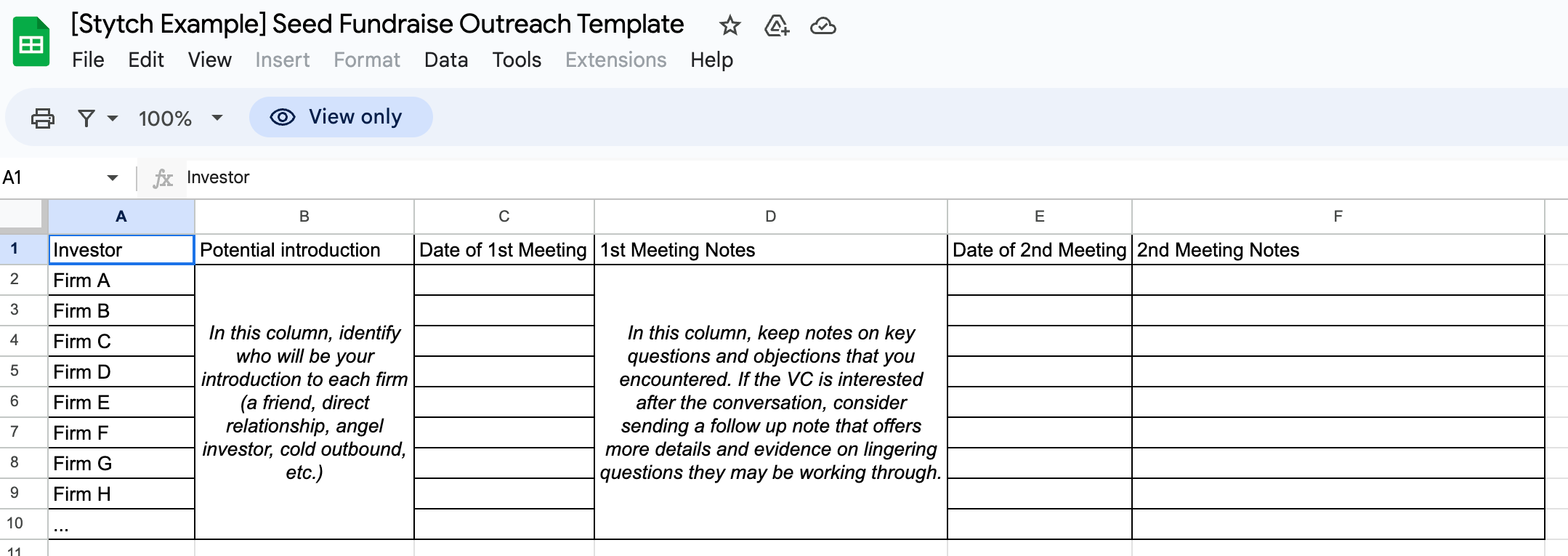

One small piece of advice when starting out is to maintain a simple spreadsheet of every firm you want to meet, your potential point of introduction, and notes from your meetings with those investors. This spreadsheet is most helpful at the beginning of your process when you’ll want to kick off your introductions to each of those firms in as compressed of a timeline as possible.

Make your own copy of this template

Keep timing tight and maintain leverage

Running a fundraising process can very quickly turn into an all-consuming effort that ends up distracting you from what you need to be focusing on, which is building your product. With that in mind, you’ll want to be intentional about keeping timelines as tight as possible, which means condensing everything into 2-4 weeks if you can. Treat it as your full-time job during this period.

Moreover, as a part of this tight process, you’ll want to kick off as many VC conversations as possible simultaneously in order to keep them on similar timelines. This will reduce the likelihood of VCs sharing information amongst themselves, which means you can maintain more of an advantage in your pricing negotiations. And finally, don’t underestimate the power of FOMO – keeping the process short means competing VCs are less likely to hear about funds that may have passed on you, ultimately keeping VC interest as high as possible.

There are many other important elements to a fundraise, but the above considerations for crafting your pitch deck and being intentional with your timeline are the most helpful learnings I had during Stytch’s seed raise. If you have any questions, feel free to reach out to startups@stytch.com to ask for anything – we’re happy to provide input on your seed deck and fundraising strategy!

Authentication & Authorization

Fraud & Risk Prevention

© 2025 Stytch. All rights reserved.